IndonesianTalk.com – The Capital Sensitivity Analysis Index (CSA Index) for May 2024 has been released by the Indonesian Securities Analysts Association (AAEI) and CSA Community, with support from the Indonesian Capital Market Professional Association (PROPAMI) and the Indonesian Issuers Association (AEI), Jakarta (1 /5/24).

The results show a less encouraging picture for market players, with optimism indicators at their lowest since the beginning of the year.

According to data collected from April 17 to 29 2024, the CSA Index in May recorded a figure of 51.4, a significant decrease from the previous figure which was at the level of 65.8 in April.

This decline indicates that market players, although still maintaining hope, are increasingly doubtful about the performance of the Composite Stock Price Index (IHSG) in the coming period.

Decreased Optimism and Factors That Influence It

This decline in market player optimism is the main highlight in the CSA Index results for May 2024.

Analysts highlight several factors that are the main causes of the current uncertainty:

Monetary Sentiment and Exchange Rate: Monetary sentiment is still tight and the weakening of the Rupiah exchange rate is the main concern for market players.

Uncertainty in monetary policy, especially related to the decision of the US Federal Reserve, puts additional pressure on the Rupiah exchange rate and slows economic growth projections.

Global Geopolitical Conditions: Instability in geopolitical conditions following increasing tensions in the Middle East and uncertainty due to the conflict in Ukraine also influenced market sentiment.

This creates greater uncertainty in global financial markets, including in Indonesia.

Foreign Investment Flow: Looking at the April data, it can be seen that foreign investors made net sales. This shows that global uncertainty also influences foreign investors’ interest in the Indonesian capital market.

Short Term and Long Term Projections

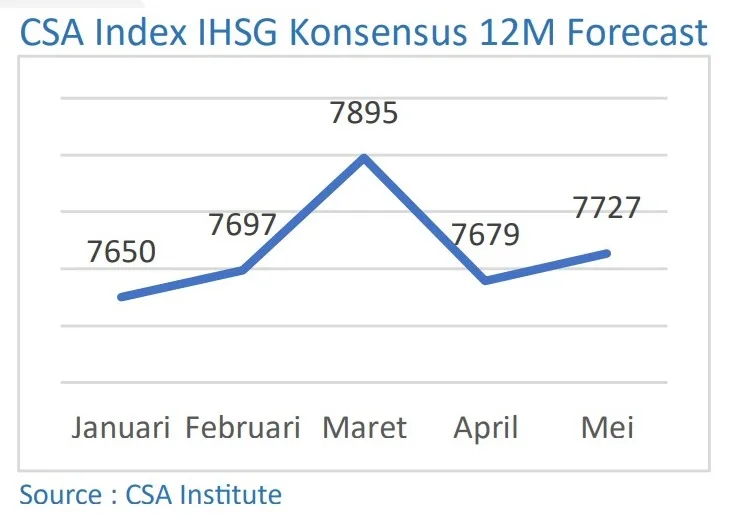

Even though there has been a decline in optimism in the short term, in long term projections, market players still maintain optimism.

The CSA Index for the next 12 months recorded 94.6, showing an increase from the previous level.

Market players still believe that the JCI has the potential to strengthen in the long term.

Responding to the CSA Index May 2024 results, NS. Aji Martono, General Chair of Propami, stated that although market players’ optimism weakened in the short term, in the long term they were still very optimistic.

He hopes that there will be positive sentiment and pro-market policies that can restore optimism about the JCI’s performance.

Sectors that have the Potential to Drive JCI Performance

The CSA Index also looks at sectors that have the potential to be the main drivers of JCI performance in May.

The Energy sector is the main choice of market players, replacing the dominance of the Financials sector.

Uncertainty in monetary policy and the potential for strengthening energy commodity prices are factors driving the positive performance of this sector.

Apart from that, the Basic Materials sector is also the choice of market players this May.

With market players’ declining optimism in the May 2024 CSA Index, it appears that uncertainty from both internal and external factors is still the main challenge for the Indonesian capital market.

However, with long-term projections remaining optimistic and the potential for certain sectors to drive JCI performance, market players still maintain hope for market recovery in the longer term.

However, efforts to create positive sentiment and policies that support the market remain key in overcoming the existing uncertainty.