IndonesianTalk.com — Indonesia’s capital market is once again being tested by longstanding issues that remain unresolved: uneven liquidity, limited ownership transparency, and inconsistent rule enforcement. (Feb 1, 2026)

Amid the country’s growing need for long-term financing to support national economic development, these structural weaknesses continue to limit Indonesia’s competitiveness in attracting global institutional capital.

Against this backdrop, the Indonesian Capital Market Professional Association (PROPAMI) has expressed support for the Financial Services Authority (OJK) through eight accelerated action plans aimed at strengthening capital market integrity.

The initiative is not framed merely as a technical refinement, but as a structural correction intended to restore market credibility and reinforce the long-term foundations of Indonesia’s capital market industry.

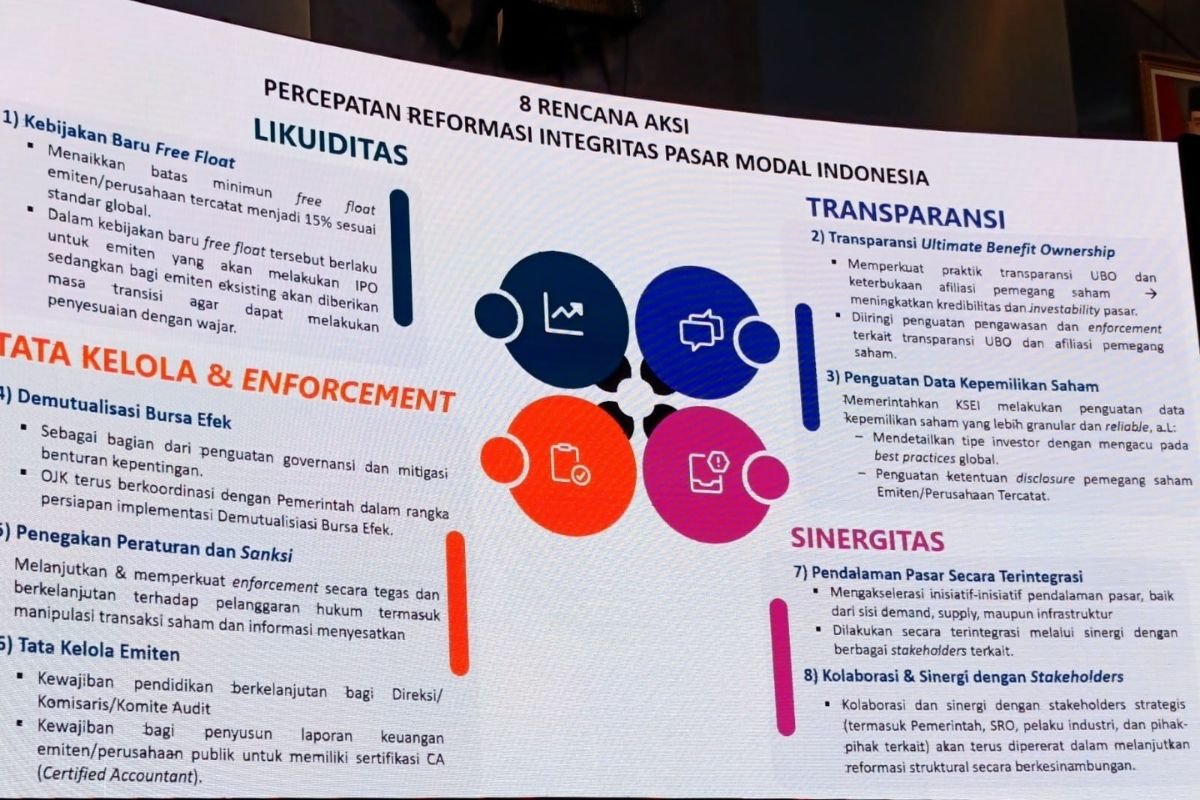

The eight action plans are built upon four key pillars: liquidity, transparency, governance and law enforcement, as well as market deepening and synergy. These pillars acknowledge that Indonesia’s capital market challenges are systemic and interconnected.

Liquidity: Addressing the Root of Market Distortion

One of the primary reform focuses concerns market liquidity, which is widely seen as failing to reflect the size of Indonesia’s economy. Many large-cap stocks still have limited free float, resulting in thin trading volumes and vulnerability to price distortion.

To address this condition, the reform proposes a new free float policy, raising the minimum public ownership requirement of listed companies to 15 percent, in line with common global market practices.

PROPAMI views this policy as crucial to expanding genuinely tradable shares, improving price discovery, and reducing excessive dominance by controlling shareholders in daily trading activities.

However, the policy is designed with a transition period for existing issuers. A gradual approach is considered essential to prevent market shocks while allowing companies with concentrated ownership structures to adjust.

Transparency: From Formal Compliance to Investor Trust

The second pillar places transparency at the core of investor confidence restoration. One key agenda is strengthening disclosure of Ultimate Beneficial Ownership (UBO), including shareholder affiliations.

In practice, layered ownership structures remain common in Indonesia’s capital market.

For institutional investors, unclear beneficial ownership increases perceived risk, particularly regarding related-party transactions and potential conflicts of interest.

By strengthening UBO disclosure, the reform seeks to move transparency standards beyond administrative compliance toward substantive openness.

This effort is reinforced through improvements in share ownership data managed by the Indonesian Central Securities Depository (KSEI). PROPAMI supports the provision of more granular and reliable data, including investor classification and improved ownership disclosure quality.

Robust data is considered a prerequisite for effective oversight and credible policymaking.

Governance and Enforcement: The Crucial Test of Reform

The governance and law enforcement pillar is viewed as the most critical test of the entire reform agenda. One strategic proposal involves the demutualization of the stock exchange to separate commercial and regulatory functions.

This separation is seen as essential to mitigating conflicts of interest and strengthening exchange governance as a core capital market institution.

At the same time, reforms demand a new approach to regulatory enforcement. PROPAMI stresses that violations—including stock price manipulation and the dissemination of misleading information—must be addressed firmly, consistently, and sustainably.

Without credible enforcement, structural reform risks losing legitimacy among market participants.

Governance improvements are also directed toward listed companies themselves. The reform promotes higher governance standards through continuous education for directors, commissioners, and audit committees, along with competency or certification requirements for financial reporting professionals.

This reflects a shift from formal compliance toward professional accountability.

Market Deepening and Synergy: Beyond Expansion

The fourth pillar emphasizes integrated market deepening covering demand, supply, and infrastructure aspects.

The reform rejects partial approaches that have often resulted in fragmentation rather than sustainable liquidity.

Within this framework, collaboration across stakeholders becomes critical.

PROPAMI encourages stronger synergy between OJK, government institutions, self-regulatory organizations, industry players, and professional associations.

According to PROPAMI, capital market reform cannot rely on a single authority but requires collective commitment across the ecosystem.

Between Agenda and Credibility

PROPAMI’s support for OJK’s eight action plans reflects recognition that Indonesia’s capital market needs more than quantitative growth.

Integrity, transparency, and consistent rule enforcement are prerequisites for restoring and maintaining investor confidence.

However, financial market history shows that credibility is built not through policy declarations, but through consistent implementation.

For investors, the true measure of reform success lies not in narrative but in tangible changes in market structure and participant behavior.

Amid intensifying global competition for long-term capital, the eight action plans supported by PROPAMI and OJK will determine whether Indonesia’s capital market can transform into a credible, deep, and sustainable marketplace—or remain trapped in recurring structural challenges.