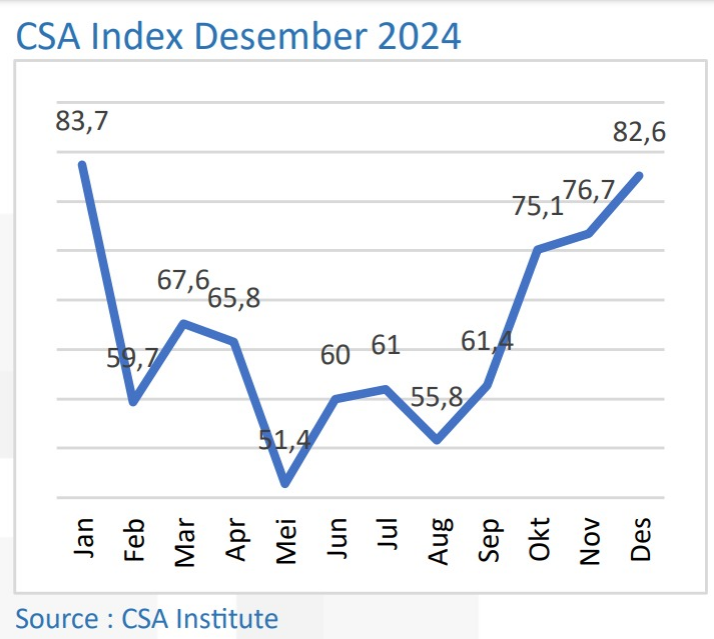

INDONESIANTALK.COM – In the latest developments, the Capital Sensitivity Analysis Index (CSA Index) has shown significant improvement, reaching 82.6 in December 2024.

This figure reflects a resurgence of market optimism, in line with the results of the United States presidential election, which has also influenced investor sentiment.

Data collected between November 15 and 30, 2024, indicates that this optimism is not merely temporary.

The CSA Index has returned to the same level seen at the beginning of 2024, signaling a positive trend that has been ongoing since August.

The potential for year-end window dressing has been a major driver of this optimism.

Several positive factors have also contributed to market sentiment.

The newly formed government is projected to adopt more aggressive policies in support of economic development and political stability, which is expected to bolster domestic investor confidence.

Bank Indonesia (BI) has reduced interest rates to 6.00% by the end of the year, aimed at improving market liquidity.

Credit growth is expected to rise between 10% and 12%, driven by higher government spending and the recovery of consumer purchasing power, particularly in the consumption and telecommunications sectors.

According to Telegraf, NS. Aji Martono, Chairman of Propami, shared his views on the December 2024 CSA Index results.

He stated, “Market participants are optimistic about the potential for window dressing, which could strengthen the IDX Composite Index (IHSG).”

Meanwhile, The Federal Reserve is expected to begin lowering interest rates by the end of 2024, potentially attracting foreign capital inflows into Indonesia’s stock market.

China, Indonesia’s primary trading partner, is also showing signs of economic recovery, which could boost demand for Indonesian export commodities, particularly in the metals and energy sectors.

However, challenges persist. Political and geopolitical tensions, along with uncertainties surrounding elections in major economies, may create market volatility.

Fluctuations in the rupiah’s exchange rate against the US dollar could also pressure sectors reliant on imported raw materials.

While external sentiment poses challenges for the IHSG, robust domestic prospects provide hope for positive movements through the end of 2024.

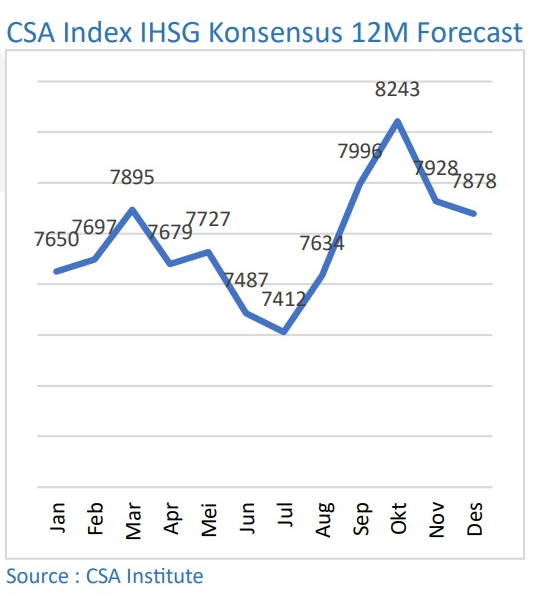

For the first time, all market participants have expressed optimism about the IHSG’s performance over the next 12 months.

Although this sentiment has improved compared to November, IHSG’s target has been revised downward.

Market participants predict that IHSG could close at 7,878, reflecting a 4.01% gain over the next 12 months.

This more realistic target follows the corrections seen in November.

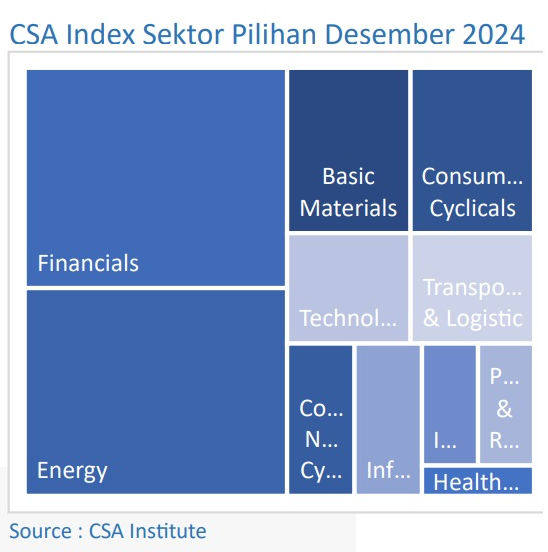

The CSA Index has also identified the key sectors expected to drive IHSG in December.

The Financial sector remains the top choice for market participants, continuing the trend observed in recent months.

Alongside the Financial sector, the Energy sector is also viewed as an attractive investment option, given the high market capitalization of many listed companies.

These two sectors are expected to serve as the primary drivers of IHSG’s growth moving forward.

Amid various positive sentiments and existing challenges, the market remains optimistic as it approaches the end of 2024.

Investors are encouraged to capitalize on this momentum to seize opportunities in the market.